Case Study: Who Manages The Money? How Foundations Should Help Democratize Capital – Press Release

ABFE and Progress Investment Management Company Release Case Study of W. K. Kellogg Foundation’s Work to Engage Minority Investment Managers

Who Manages the Money? How Foundations Should Help “Democratize Capital” Report is set for Release on October 22, 2014

[October 16, New York, NY] ABFE: A Philanthropic Partnership for Black Communities and Progress Investment Management Company are set to release a significant case study that serves as both a narrative of the W.K. Kellogg Foundation’s journey toward more inclusive investment management practices and a road map for other foundations interested in leveraging endowments for more equitable and inclusive strategies while accessing competitive returns.

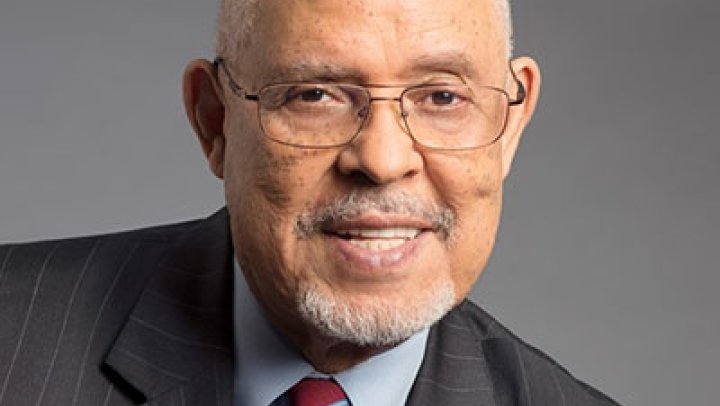

“Over the past 25 years many public and corporate pensions have been at the forefront of a movement to democratize capital and create opportunities for best-in-class minority-owned investment managers to add value to their investment portfolios,” noted Thurman White, President and CEO of San Francisco, Californiabased Progress Investment Management Company, and the paper’s author. “But the Foundation community in general has lagged behind in this effort. The W.K. Kellogg Foundation has aligned its overall mission and beliefs about diversity with the opportunity to enhance its investment returns. Our firm has developed a successful model working with this foundation that we wanted to highlight as instructive for other foundations,” White explained.

White concluded, “We hope Who Manages the Money? How Foundations should help to democratize capital will stimulate dialogue within the foundation community. This case study provides valuable lessons learned about how one foundation has successfully diversified who it does business with in managing its investment portfolio.”

“ABFE is always pleased to lift up successful examples of foundations pursuing equity and inclusion goals across all aspects of their work and operations,” states Susan Taylor Batten, President and CEO of ABFE. “Beyond the obvious opportunity for realizing competitive returns, we know that growing the field of minority managers is an important equity issue for building wealth in communities of color; creating pipelines for future, diverse investment talent; and sparking even greater opportunities for philanthropic support for our communities.” For the past three years, ABFE has worked under its SMART Investing initiative to educate foundations about the performance and other benefits of casting a wider net and intentionally seeking diversity of minority- and women-owned firms in their manager line-ups. In addition to distributing other papers in the field, ABFE has developed a resource for foundations to find managers for further research and due diligence – ABFE’s Directory of Minority- and Women-Owned Investment Management firms – available here.

The Report – To find out more information and to access “Who Manages the Money? How Foundations Should Help “Democratize Capital” report, see below:

Executive Summary is available here

The full version of the report is available here

The webinar will take place on Thursday, November 20, 2014 at 2:00pm EST. Space is limited. Reserve your Webinar seat now at: https://www1.gotomeeting.com/register/329271120

To view the full version of the report and register for the webinar, visit www.progressinvestment.com and www.abfe.org

About ABFE: A Philanthropic Partnership for Black Communities – ABFE is a membership-based philanthropic organization that advocates for responsive and transformative investments in Black communities. Partnering with foundations, nonprofits and individuals, ABFE provides its members with professional development and technical assistance resources that further the philanthropic sector’s connection and responsiveness to issues of equity, diversity and inclusion. About Progress Investment Management Company – Progress Investment Management Company is a pioneer in the field of investing with emerging managers — small, independent, diverse asset management firms including those owned and led by ethnic minorities, women and disabled veterans. Progress specializes in multi-manager investment strategies featuring emerging firms, managing over $9 billion in assets for some of the world’s largest and most sophisticated institutional investors. ###